Explore key trends in Malaysia’s industrial real estate market from 2020 to 2025, including pricing shifts, logistics demand, and infrastructure impacts.

Industrial Property Price Trends in Malaysia: 2020–2025 Overview

Over the past five years, Malaysia’s industrial real estate market has shown resilience and steady growth despite global economic headwinds. From the initial uncertainty of the COVID-19 pandemic to the rise of e-commerce and logistics-driven demand, the industrial sector has undergone significant transformation. This blog outlines the key trends, price movements, and what’s shaping industrial property values from 2020 through 2025.

1. Price Stability During COVID-19 (2020–2021)

-

Demand held steady, particularly for logistics and warehousing assets, as businesses rushed to build pandemic-resilient supply chains.

-

Rental rates remained stable, with slight growth in key logistics hubs like Klang and Johor.

-

Developers shifted focus from commercial/retail to build-to-suit and ready-built industrial facilities, maintaining market confidence.

2. E-Commerce & Logistics Drive Demand (2021–2023)

-

The rise of e-commerce accelerated warehouse absorption, especially near urban centers.

-

Key industrial zones near Port Klang, Shah Alam, and Senai witnessed:

-

Land price appreciation of 5–10% annually

-

Increased demand for larger footprints and high-ceiling warehousing

-

-

Multinationals and logistics players actively sought freehold land or long-tenure leasehold properties for long-term investment.

3. Infrastructure Projects Boost Land Values

-

Major government-led infrastructure like:

-

ECRL (East Coast Rail Link)

-

West Coast Expressway

-

Expansion of Port Klang and Senai Airport

created ripple effects in surrounding industrial land prices.

-

-

Strategic corridors (e.g., Kapar, Nilai, Bandar Enstek) recorded 8–15% appreciation in land value due to improved connectivity.

4. 2024–2025: Market Normalization with Continued Upside

-

As Malaysia’s GDP growth recovers post-COVID and supply chains stabilize:

-

Industrial land prices are expected to rise moderately by 3–6% per year

-

Investors are turning to second-tier locations such as:

-

Ipoh (for Northern access)

-

Melaka (for port proximity)

-

Kuantan (linked to ECRL)

-

-

-

High demand continues for:

-

Build-to-suit facilities

-

ESG-compliant buildings

-

Bonded warehouses and Free Industrial Zones

-

5. Key Factors Influencing Price Trends

| Factor | Impact |

|---|---|

| Infrastructure Development | Boosts land desirability |

| Port/Airport Accessibility | Increases value for logistics use |

| Land Tenure (Freehold vs Leasehold) | Affects investor preference |

| BOMBA & Regulatory Compliance | Impacts development readiness |

| ESG & Automation Readiness | Adds premium for future-proof assets |

6. What Buyers & Investors Should Watch

-

Track upcoming industrial park launches and infrastructure alignments (especially ECRL, WCE).

-

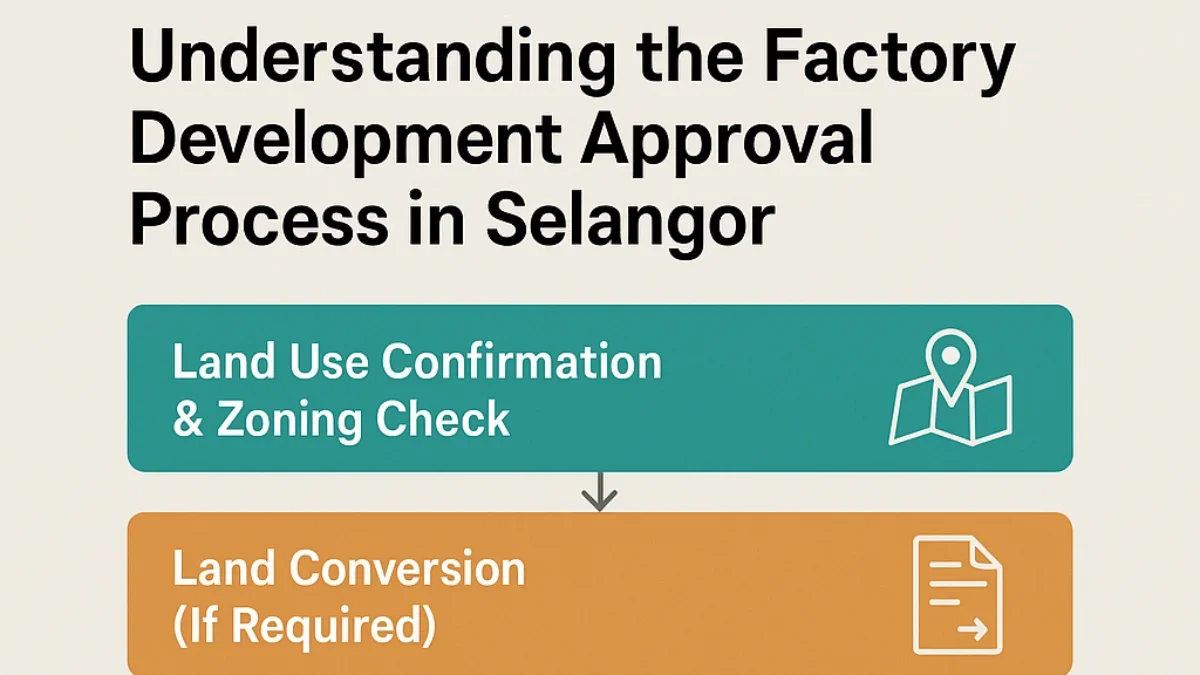

Engage in due diligence on zoning, approvals, and soil condition before purchase.

-

Consider regions with:

-

Dual-frontage or highway exposure

-

Nearby talent hubs or labour townships

-

Flexible layout potential (for conversion or expansion)

-

Conclusion

From 2020 to 2025, Malaysia’s industrial real estate market has proven to be one of the most stable and opportunistic sectors. With continued infrastructure improvements, demand from logistics and manufacturing, and strong government support, the industrial property sector remains a bright spot for both local and foreign investors.

Contact us Call Kenneth 017-380 9993 Or WhatsApp our team directly for the latest availability